Direct Market Access Dma For Retail Investors?

DMA lets you interact with stock or forex exchanges instantly – bypassing any aggregation of over-the-counter orders – so you probably can select the price you need to deal at. We wish to clarify that IG International doesn’t have an official Line account at this time. We haven’t established any official presence on Line messaging platform. Therefore, any accounts claiming to symbolize IG International on Line are unauthorized and should be considered as fake.

In this section, we will explore the advantages, challenges, and finest practices of direct marketing from totally different perspectives. Both Smart Order Routing and Direct Market Access have their pros and cons, and traders have to rigorously consider their individual wants before choosing one over the other. It’s necessary to understand the variations between the 2 strategies and the way they’ll influence trading effectivity and profitability. Navigating DMA is a balancing act between exploiting its benefits and managing its inherent dangers. To harness its full potential, merchants and establishments must constantly adapt, innovate, and adhere to best practices on this fast-paced surroundings. On the other hand, with a retail account, there is not a transparency since the dealer has the discretion to pick the gateway.

What Is Direct Market Access (dma) In Trading?

DMA presents energetic investors a variety of advantages that may improve their trading expertise. From elevated velocity and transparency to customization and price efficiency, DMA empowers investors to take control of their trades and maximize their profitability. By leveraging the benefits of DMA and following effective trading methods, lively traders can keep ahead within the dynamic world of economic markets. Direct market entry has empowered particular person traders by offering them with greater control, transparency, and cost savings of their funding actions. By following the ideas mentioned above and learning from real-life case research, buyers can harness the complete potential of direct market entry and improve their funding outcomes.

Companies that supply direct market entry sometimes mix this service with access to superior trading methods such as algorithmic trading. Thus, there are agreements between direct market entry platform owners and sponsored firms that define https://www.xcritical.com/ the providers supplied and the stipulations of the agreement. DMA in buying and selling is brief for ‘direct market access’, which describes dealing immediately onto the order books of main exchanges through a buying and selling (DMA) dealer.

With DMA, merchants can see the depth of the market and select to execute their orders at the bid or ask prices displayed by liquidity providers. A DMA buying and selling platform can also be very useful for block trades, as direct market entry software program is prepared to put massive volumes of trades in a single go, with a speedy execution and results. Let’s contemplate a case examine for example the significance of direct prices in a software development firm.

Direct-access Broker: What It Means, How It Works, Example

We must say that ULLDMA service might be really costly in terms of infrastructure. Afterwards, the trader will place the order and the dealer will do a fast verify to find out the margin for opening the place out there. After the mandatory checks, the dealer will be able to see different market participants’ orders and gauge the market state of affairs for putting the commerce order. Spread bets and CFDs are advanced devices and include a high threat of losing cash quickly as a result of leverage. 71% of retail investor accounts lose cash when spread betting and/or trading CFDs with this provider.

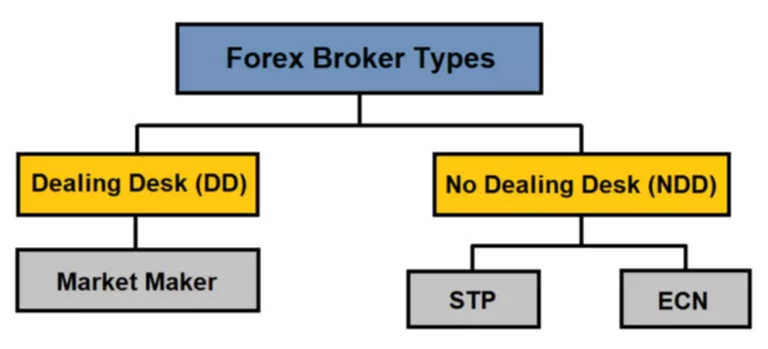

Direct market entry is a faster strategy that makes the proprietor of direct market access be in command of the entry-exit positions immediately. We also discussed the various varieties of direct market access and the disadvantages of the same. Contract for Difference (CFD) is a sort of contract which enables the investor to trade within the course of the currency pairs as an alternative of trading with the spot quotes. Some foreign exchange direct market access brokers may let you trade this type of derivative immediately with banking institutions.

Rather than counting on market-making firms and broker-dealers to execute trades, some buy-side corporations use direct market access to place trades themselves. In a producing firm, the cost of uncooked supplies used within the production process is a direct cost. This value could be simply attributed to a selected product as it is instantly consumed during manufacturing. Similarly, the wages of employees immediately involved in the production course of, corresponding to meeting line workers or machine operators, are additionally thought-about direct prices. In abstract, understanding direct costs is pivotal for effective cost administration, pricing strategies, and total business success. By dissecting these prices and considering real-world examples, businesses can optimize their operations and achieve sustainable profitability.

Understanding Direct Costs[original Blog]

With DMA, traders can see the depth of the market and the available liquidity, allowing them to make extra informed buying and selling selections. Additionally, DMA allows merchants to position orders directly into the market, rather than going through a broker or market maker. This signifies that trades may be executed extra rapidly and at more favorable prices. In the ever-evolving landscape of financial markets, merchants and investors are continually looking for tools and techniques to realize a competitive edge. One such software that has gained important prominence lately is direct Market access (DMA).

When a shopper trades a contract for distinction using DMA CFD trading, the supplier instantaneously locations a corresponding order in the direct market. The order placed by the supplier in the direct market mirrors the value, volume and instructions of the CFD. This order appears as a person entry on the order books of the ECN or trade.

Additionally, DMA supplies merchants with access to a wider range of liquidity suppliers, growing the probabilities of discovering the best available costs. In the fast-paced world of contemporary monetary markets, merchants and buyers are continuously looking for new and efficient methods to achieve an edge. One such avenue that has gained significant prominence is direct Market access, generally known as DMA.

Ultra-low Latency Direct Market Entry (ulldma)

For instance, the value of uncooked materials will increase as production volume rises. On the contrary, fixed direct prices remain constant regardless of manufacturing ranges. Direct material costs are the expenses incurred in purchasing or producing the raw supplies which are directly used within the manufacturing course of. These costs may be easily traced to a specific product, making them a major example of direct prices. For instance, in the vehicle business, the value of metal, rubber, and different materials instantly used within the assembly of a automotive can be thought-about direct material prices.

In the previous, these HFT corporations have been accused of betting towards retail traders. In this text, we’ll look at the idea of Direct Market Access (DMA) and its key differences with retail traders. On the far proper we now have Ultra Low Latency and Low Latency Direct Market Access (ULLDMA and LLDMA respectively) but direct market access example the costs to develop and support that entry methodology are excessive. Some market making brokers only cost commissions for every transaction when buying and selling forex, and others cost their fees on the same spread.

Liquidity suppliers are entities that hold a large quantity of a monetary product. They provide financing for the security and then facilitate its buying and selling within the direct market. Since they ‘make the market’ for the safety, they’re therefore sometimes called market markers. Today, traders can commerce securities by inserting orders immediately on the order books of inventory exchanges and digital communication network brokers (ECNs) through direct market access (DMA trading).

CFD trading on shares and foreign exchange allows you to go lengthy or short on prices without taking ownership of the underlying belongings. When you place a trade, IG takes the position within the underlying market and you receive a CFD with us. Direct advertising encompasses a broad range of tactics, including junk mail, telemarketing, e mail advertising, and face-to-face sales. Each technique has its personal strengths and may be effective in reaching particular target audiences. For example, junk mail can be an impactful method to attain older demographics, while e mail advertising could resonate more with youthful, tech-savvy consumers.

Therefore, buyers can commerce in equities, fixed earnings securities, financial derivatives, or another monetary instrument. Many traders prefer direct market entry (DMA) as a end result of it allows them to deal directly onto the order books of major exchanges. These are a few of the main features and problems with direct prices in cost calculation. By understanding and addressing them, you can enhance your price calculation skills and outcomes, and obtain your targets and goals.

Order Execution

One of the main advantages of direct market entry is the low latency it presents in comparability with the router layer that some brokers have. The core of an trade is its matching engine — the technology that matches a purchase order and a promote order towards a bid and ask price to generate a commerce. This trade worth (LTP) and open orders are streamed to brokers who use this to feed their trading platforms (marketwatch, charts, and so on.). The order is accepted by the exchange for which the security trades and the transaction is recorded on the exchange’s order e-book. Intermediary brokerage firms are identified to have direct market entry for completing commerce orders.